I. Introduction

Last week Argentina launched an exchange offer to restructure its public debt subject to foreign law. Certain bonds issued under the 2005 Indenture and the 2016 Indenture are eligible to be tendered in the exchange under which Argentina offers five new bonds due in 2030, 2036, 2039, 2043 and 2047. Holders tendering their bonds would also consent to modify any eligible bonds of the relevant series that remain “outstanding” after giving effect to the exchange offers.

The exchange offer represents challenges with respect to its economic terms and conditions as well as its legal aspects.

From an economic standpoint, the new bonds have a two-year initial grace period, followed by very low step-up interest rates. Some of the exchange bonds include haircuts on principal amounts and holders who accepted the exchange will not be entitled to receive any cash payment or additional consideration for any interest accrued and unpaid since the last applicable interest payment date on any eligible bond that is exchanged. These aspects have made some creditors point out that there is room for improvement.

From a legal standpoint, there are also several issues that trigger sensitive key issues. A relevant aspect of the offer is that Argentina reserves the right to re-designate, at any time (including after the expiration date of the offer), the series of eligible bonds that will be aggregated for the purpose of obtaining the consents required under the CAC clauses of the 2005 Indenture and the 2016 Indenture. Argentina would be able to exclude one or more series for the purpose of achieving the required consents. The required consents would also authorize Argentina to determine whether the requisite consents have been met for the proposed modifications affecting any of the excluded series on a single series basis.

Under this context, there are some key legal issues to follow up closely.

II. Key Legal Issues

1. Is a Restructuring in Stages Feasible?

Argentina has the right to: (a) accept tender offers, even if no CAC majority is obtained, and (b) exchange the series in which the CAC majorities were obtained, while the other series remain outstanding.

However, if Argentina follows this strategy, close attention should be given to the definition of “Outstanding”. If these exchanges reduce the amount of “Outstanding” debt under the CAC provisions, making further exchanges may become more difficult as Holdouts will increase their participation in the series and indentures.

In the event that a series is exchanged as a result of a CAC, Holders that accepted the exchange will have certain protection from a restructuring in stages by the RUFO provisions. But Holders of 2016 Indenture Bonds which did not accept the exchange will be unprotected if their series is exchanged under a CAC since they will receive New 2047 Bonds that will not have RUFO provisions.

2. Will Re-designation be challenged?

The re-designation right is a novel feature of the offering. Basically, Argentina is seeking consent under the two limb aggregate method for both the 2005 Indenture and 2016 Indenture considering all series as “affected” and subject to this method. However, Argentina’s legal position under the exchange offer is that it may disaffect any series and either force the exchange in such series if a 75% acceptance of such series is achieved individually or leave such series outstanding if such threshold is not reached.

The re-designation right will allow Argentina to decide on the method applicable to each series after the offer expires and the level of acceptance of all series is known.

Holders that are forced to exchange their Eligible Bonds for New Bonds as result of a re-designation of their class may attempt to challenge the provision. The issue is far from clear, but in view of the language of each indenture, Holders of 2016 Indenture Bonds may have a better case in the event of a challenge.

The entire re-designation structure is quite innovative and dependent on the results and actions taken by Argentina, so no assurance can be given to Holders as to the outcome of potential challenges.

3. Can Argentina Partially Restructure and Continue to Perform on Eligible Bonds?

This is an option available to Argentina. There is no obligation under the New Bonds to cease payments under the Eligible Bonds. The RUFO provisions protect Holders of New Bonds (other than New 2047 Bonds) in the event of a new offer to Holders of Eligible Bonds. However, Argentina does not need to make a new offer to continue paying them. A stands till similar to the one requested by Ecuador may be more problematic since that standstill resulted in the amendment of the Indentures and terms of the Bonds, which would arguably be covered by the RUFO provision.

III. Highlights of the Offer

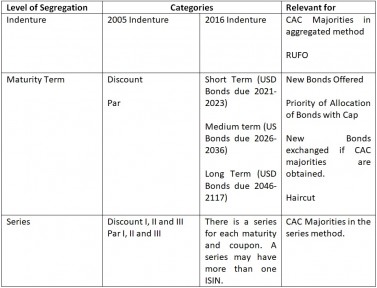

1. The Eligible Bonds are divided and grouped at three different levels.

- The Grouping for USD denominated Eligible Bonds is below (Euro Bonds have a similar Grouping).

2. The Tender Offer by the Holder is not conditioned to a minimum acceptance rate or success of the proposed exchange under the CAC.

- The Holder takes two actions when accepts the invitation of Argentina:

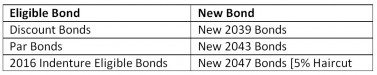

(1) Tender Offer. The submission of a Tender Offers to exchange their Eligible Bonds for the New Bonds it elected. The Holder of each class of Eligible Bonds has a choice of two or three New Bonds, with haircuts ranging from 0% to 12% (18% for Bonds in Euros)

(2) Consent under CAC. The Holder consents under the Collective Action Clause (“CAC”) to the exchange of all Eligible Bonds of non-accepting Holders (“Holdouts”) for New Bonds (Proposed Modifications),

- The Tender Offer is not conditioned to the success of the Proposed Modifications. Argentina may accept the Tender Order even if the Proposed Modifications of the remaining Eligible Bonds of that series are not adopted.

- Argentina reserves the right not to accept Tender Offers of Eligible Bonds of any series. Argentina may exchange the Bonds of Holders that accept the offer regardless of the rate of acceptance. Furthermore, Argentina is not obligated to accept the Tender Offers

3. A proposal under the CAC to Exchange the Eligible Bonds of Holdouts for New Bonds (Proposed Modifications)

- Argentina is using the CAC to propose a forced exchange of the Eligible Bonds of Holdouts for New Bonds. In the event that the CAC majorities are obtained, the Holdouts will receive the following New Bonds in exchange for their Eligible Bonds:

- Holdouts of 2016 Indenture Eligible Bonds would receive New 2047 Bonds which are the only bonds without a RUFO provision.

- The Eligible Bonds denominated in USD will be exchanged for New Bonds denominated in USD, the Eligible Bonds denominated in Euro or Swiss Francs will be exchanged for New Bonds denominated in Euros.

- The approval of the Proposed Modifications is subject to approval by the majorities set forth under the CAC rules.

4. Timeline of the Invitation. Expiration Date. Extension. Termination. Amendment of Terms. Revocations.

- The Expiration Date is May 8, 2020 at 5:00 P.M. (EST). The Clearing Systems and Custodian can have shorter deadlines. Timing is of the essence because Argentina failed to make payments due on April 22 on some Eligible Bonds. The grace period is 30 days.

- Until the acceptance of any tenders is announced on the Results Announcement Date (exp. May 11, 2020), Argentina may terminate the Invitation, extend the expiration date or amend the invitation.

- If Argentina makes any material change to the terms of, or waives a material condition of, this Invitation, and the material change or waiver is adverse to the interests of the Holders, it will extend the Expiration Date.

- Tender Offers may be revoked at any time prior to the Expiration Date.

- Taking into account this timeline, an improvement by Argentina of its offer after May 8 is possible.

5. Accrued Interest on Eligible Bonds is lost as exchange is based only on principal.

- There is no payment of any accrued and unpaid interest on Eligible Bonds and they are not considered for the exchange ratios with the New Bonds.

6. For Discounts and Par the Exchange will result in a Change of Indenture. It may also result in a change in Applicable Law and Currency.

- All New Bonds will be issued under the 2016 Indenture, including those swapping Eligible Bonds issued under the 2005 Indenture. The main difference between the 2005 Indenture and the 2016 Indenture are that the latter requires the lower majorities under CAC and does not provide ratable payment rights.

- All New Bonds will be issued under NY law, including the New Bonds denominated in Euros replacing those under the 2005 Indenture which were under English law. There will be no New Bonds under English law.

- The Eligible Bonds denominated in Swiss Francs will be exchanged for New Bonds in Euros.

7. All New Bonds (other than New 2047 Bond) have Rights upon Future Offers clause (“RUFO”). The RUFO rights are granted by Indenture. No Ratable Payment Provision.

- The RUFO is triggered if Argentina voluntarily makes an offer to purchase or exchange, or solicits consents to amend, any relevant outstanding Eligible Bond under the same Indenture.

- The RUFO is not triggered if the Eligible Bonds continue to be paid since payment would not constitute an offer.

- The period of the RUFO is five (5) years from the Settlement Date.

- The RUFO benefits New 2030 Bonds and New 2036 Bonds if the offer is made to 2016 Indenture Eligible Bonds and to New 2039 Bonds and New 2043 Bonds if the offer is made to 2005 Indenture Eligible Bonds.

- The New USD 2047 Bonds and the New Euro 2047 Bonds will not benefit from the RUFO. These are the Bonds that Holdouts of 2016 Indenture Bonds will receive if the CAC is approved for its series.

- No RUFO if the purchase, exchange or amendment is made in satisfaction of a final, non-appealable court order or arbitral award. This is a modification from the previous RUFO.

8. Indenture 2005 CAC. Higher acceptance needed for approval on aggregate basis.

- Acceptance from Holders of (i) no less than 85% of the aggregate principal amount of 2005 Indenture Eligible Bonds (taken in the aggregate) then Outstanding, and (ii) no less than 66⅔% of the aggregate principal amount of each series of 2005 Indenture Eligible Bonds (taken individually) then Outstanding, subject to re-designation at Argentina’s discretion, is required to meet the CAC majority requirements.

- If any series of Eligible Bonds is re-designated it will be excluded from calculation. Modification will be effective for such series if accepted by no less than 75% of the aggregate principal amount of the excluded series.

9. Indenture 2016 CAC. Lower acceptance needed for approval on aggregate basis. If 2005 Indenture accepts proposal, they can be counted for 2016 Indenture.

- Acceptance from Holders of (i) more than 66⅔% of the aggregate principal amount of 2016 Indenture Eligible Bonds and 2005 Indenture Eligible Bonds (taken in the aggregate) then Outstanding, and (ii) more than 50% of the aggregate principal amount of each series of 2016 Eligible Bonds then Outstanding, subject to re-designation at Argentina’s discretion, is required to meet the CAC majority requirements.

- Acceptance of Holders of 2005 Indenture Eligible Bonds are being taken into account for purposes of determining whether the Holders of more than 66⅔% of the aggregate principal amount of Eligible Bonds have consented. Consent by a Holder of any series of 2005 Indenture Eligible Bonds is recorded only if the Proposed Modifications for 2005 series is effective.

10. Re-Designation of Affected Series

- Each Holder will also give written consent to allow Argentina, to (A) re-designate at any time (including after the Expiration) the series of Eligible Bonds that will be subject to the Proposed Modifications on an aggregated basis by excluding one or more series of the initially designated series, and (B) consider the Proposed Modifications effective with respect to a single series.

- The re-designation would allow Argentina to exclude one or more series of Eligible Bonds from the calculation of the Requisite Consents on an aggregated basis for the Proposed Modifications to the series that have not been excluded and calculate the Requisite Consent on a single series basis for all series that have been excluded.

- This re-designation right is novel. From the wording of the CAC provisions, re-designation rights seem stronger under the 2005 Indenture than under the 2016 Indenture. It is to be seen if it is challenged by Holders forced into an exchange by application of re-designation.

11. There is a Cap on Shorter Term New Bond Caps. Cap does not Affect 2005 Indenture Bonds and Shorter Term 2016 Indenture Bonds.

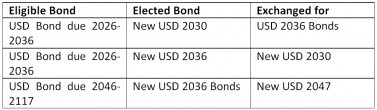

- There is a cap on the maximum issuance of the New 2030 Bonds and New 2036 Bonds. The priority in the allocation of New 2030 Bonds and New 2036 Bonds is as follows:

- Level 1 USD Bonds due 2021-2023

- Level 2 USD Bonds due 2026-2036

- Level 3 USD Bonds due 2046-2117 (cannot be exchanged for New 2030 Bonds).

- There are enough New 2030 Bonds and New 2036 Bonds for all Holders of USD Bonds due 2021-2023. They will receive the Bond they choose.

- Indenture 2005 Eligible Bonds are not exchangeable for New 2030 Bonds and New 2036 Bonds. The Bonds that Holders of Indenture 2005 Eligible Bonds can choose are not capped.

- If a cap for a Bond is exceeded and the Holder does not receive the Bond it chose, it will receive another Bond depending on which Bond it tendered and which Bond it elected. For US Bonds the exchange will be the following:

Artículos

opinión

ver todosBerken IP

Xtrategia Group